Business Insurance in and around Seattle

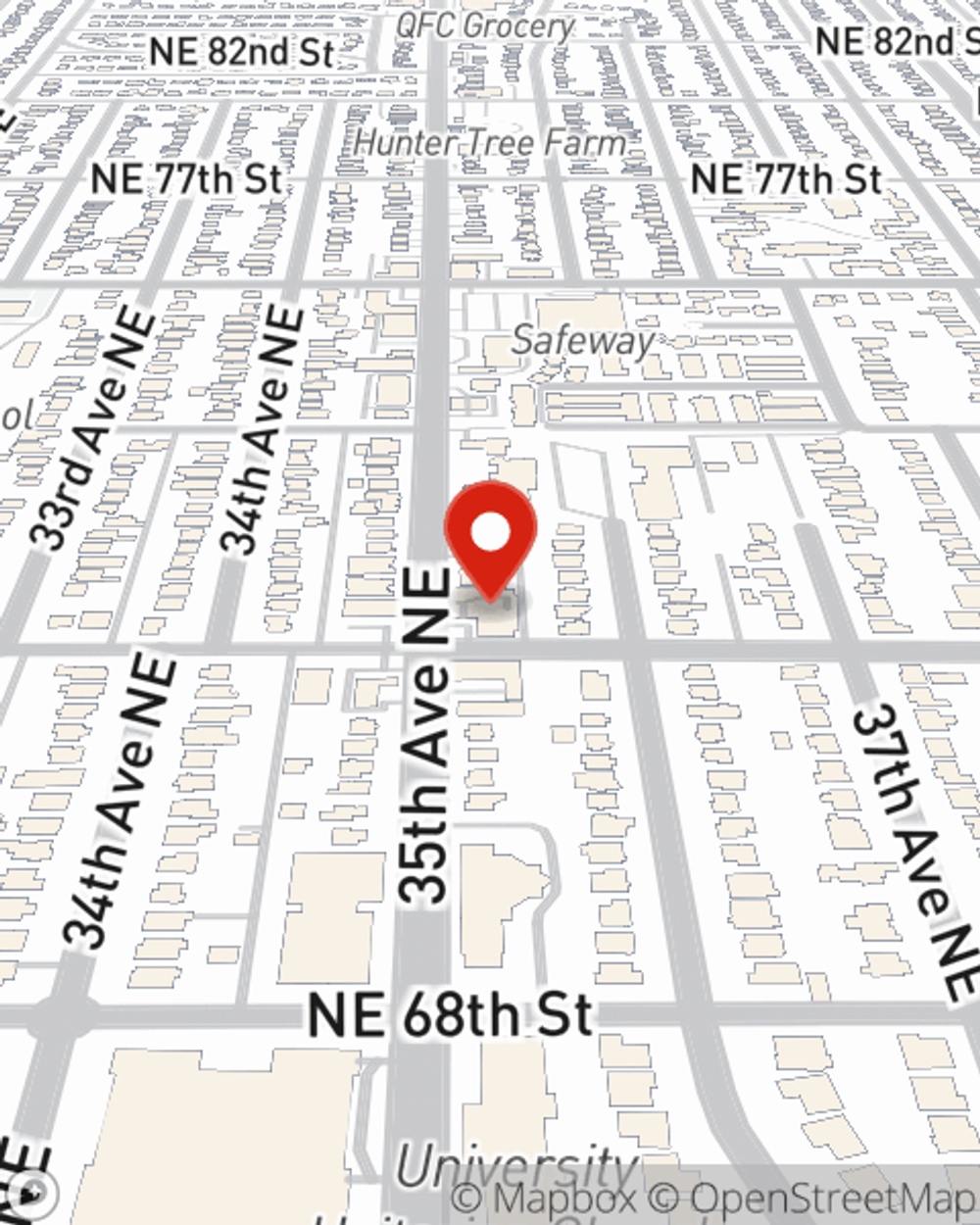

Researching insurance for your business? Search no further than State Farm agent RT Shaw!

This small business insurance is not risky

State Farm Understands Small Businesses.

Running a small business comes with a unique set of challenges. You shouldn't have to work through those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including errors and omissions liability, business continuity plans and worker's compensation for your employees, among others.

Researching insurance for your business? Search no further than State Farm agent RT Shaw!

This small business insurance is not risky

Cover Your Business Assets

At State Farm, apply for the excellent coverage you may need for your business, whether it's a clock shop, an art school or a psychologist office. Agent RT Shaw is also a business owner and understands what you need. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

Contact agent RT Shaw to consider your small business coverage options today.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

RT Shaw

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.